Can Iranian economy resist US pressure?

Obviously, due to the re-implementation of US sanctions, the Iranian economy has entered an economic crisis since 2018 characterized by a recession and a steep acceleration of inflation. According to the IMF, there was a recession in Iran in 2018 with a negative GDP growth of 3.8% and an acceleration of inflation, which reached 31.2% (after 9.6% in 2017). With a further strengthening of US sanctions, the IMF forecast for 2019 is an exacerbation of the crisis with a GDP recession of 6% and an acceleration of inflation to 37.2 %.

The main risk for the Iranian economy is a further degradation of the macroeconomic situation. To avoid this situation, the Iranian government obviously is trying to avoid a more pronounced decrease of oil exports. It is difficult to forecast what will be the future impact of the recent hardening of US sanctions. A realistic forecast would be that it is not possible for the US to bring Iran oil exports to zero. Nevertheless, one can also expect a new decrease of Iranian oil exports (which have already decreased of 56% between 2017 and April 2019 according to OPEC). It is then clear that the Iranian government should try to stabilize the economy to avoid further acceleration of inflation.

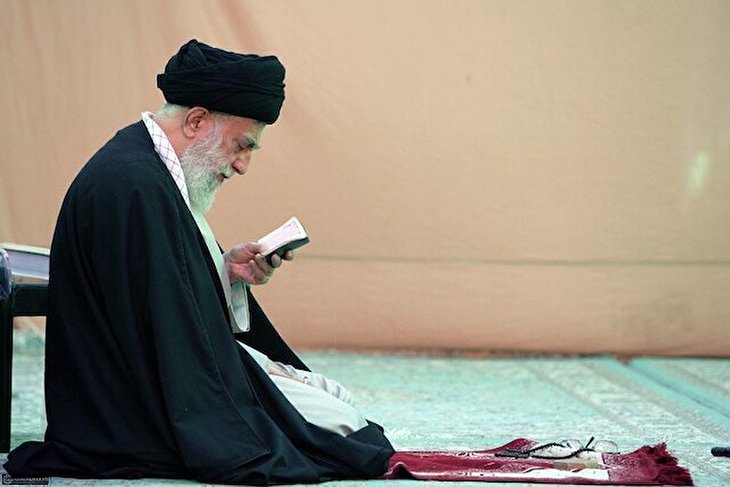

Obviously, it means to lower government expenditures to limit the present increase of the fiscal deficit. It also means limiting imports to the strict necessary to avoid further depreciation of the rial. An important issue in such a policy of stabilization is the management of people expectations. Economists know that sometimes, due to increased pessimism, exchange rate depreciation and inflation can follow a path, which amplifies the movements generated by the foreign exchange market situation and leads to very steep price increases. That is why one important issue to stabilize as much as possible the economy is to maintain what the economists call “vertical trust” - trusts in public institutions. That is why everything the Iranian government can do maintain this trust like giving the perception that the government is effectively fighting against corruption, is a key issue, which can contribute to the stabilization of the macroeconomic environment.

One has to consider that the Iranian economy benefits from a situation, which gives it some margin to limit further economic instability: it has a quite high level of foreign exchange reserves (around 100 billion $) and a low level of external debt (estimated by the IMF at 9% of GDP in 2018). Besides, the economic policy should have as another priority, the objective of limiting the social impact of inflation, especially on the lower-income groups. As in any country, these are always these groups, which suffer the most in case of higher inflation.

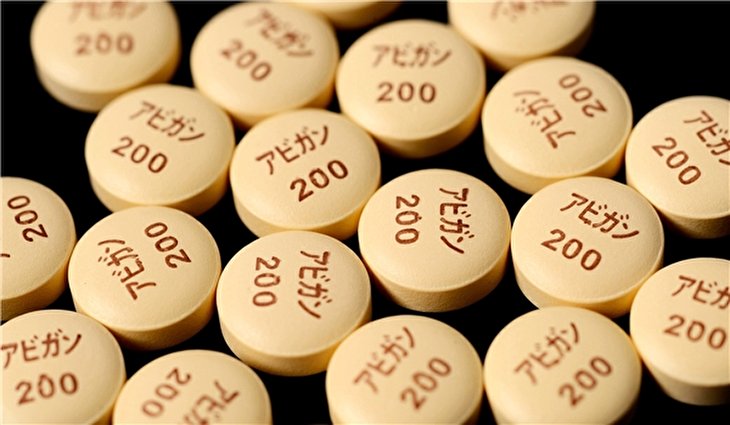

Besides, this crisis can also be an opportunity for the Iranian economy to lower its oil dependency. Obviously, in terms of fiscal policy, the impact of the US sanctions on government revenues creates a situation,which requires decisive measures. For example, the Iranian government could decrease the expenditures related to monetary cash subsidies by concentrating it on the lowest incomes. The present crisis could also be, as difficult as is the present situation, an opportunity to develop Iran non-oil exports in the region. The spectacular increase of Iran non-oil exports in Iraq during these last years, demonstrates that Middle East, Central Asia, Pakistan, Afghanistan are the “natural” markets of Iran non-oil exports. Besides, it is much more difficult for the US authorities to apply efficiently their sanctions in these countries than in richer countries more integrated in the global economy. These markets could also generate some opportunities to the Iranian high tech industry. It has to be noticed that the emerging technologies like 3D printing, artificial intelligence and robotics are not dependent as before on foreign investment but on the scientific level of a country. That means that Iran has a great potential in these industries and could start by finding markets in the region. That would require a full restructuring of the Iranian banking system to make it more efficient: this sector could then concentrate its resources to finance the most competitive sectors like the high tech industry.

Nobody can deny the severity of the present economic crisis in Iran and the fact that this situation will not improve in 2019. Nevertheless, the Iranian economy has the abilities to limit the economic and social cost associated with this crisis. This could also be an opportunity to take some measures to lower further oil dependency. In Chinese, the word crisis means both danger and opportunity.

Source:PressTV