Iran to Ride Out U.S. Sanctions Storm: Reuters

"Iran’s situation is better than pre-2016 because of high oil prices and the

fact that the U.S. is isolated this time,” it quoted a European diplomat who

asked not to be further identified.

Iran emerged in early 2016 from years of sanctions under a deal with world

powers. But President Donald Trump withdrew the United States from the deal in

May, and reimposed far-reaching U.S. sanctions in phases, with the most damaging

oil and banking penalties taking effect on Nov. 5.

The other signatories to the nuclear deal - Germany, France, Britain, the

European Union, Russia and China - have condemned Trump’s walkout from the pact.

The EU is preparing a special mechanism to enable payments for Iranian oil and

other exports without U.S. dollars, possibly through a barter system.

"It will be a difficult period but Iran’s economy will withstand it for various

reasons,” a second diplomat said, "including (the fact of) Russia being under

(U.S. and EU) sanctions, Saudi Arabia having its own financial and political

issues, and (trade war) between China and the United States.”

Big power disunity and EU moves to circumvent Trump’s sanctions regime have

given Tehran a psychological boost - but not dissuaded foreign businesses

ranging from oil majors to trading houses and shipping concerns from pulling out

of Iran for fear of incurring new U.S. penalties.

Still, while the U.S. clampdown will probably trigger recession in Iran next

year, economic meltdown should be avoided, with a reduced but still significant

volume of oil exports continuing, a Fitch solutions analyst said.

"Tehran is still likely to see a substantial share of its foreign exchange

earnings maintained,” Andrine Skjelland told Reuters. "This will enable Tehran

to continue subsidizing imports of selected basic goods, keeping the costs of

these down and thus limiting inflation to some extent.”

Iranian officials has cited Trump’s isolation in repudiating the nuclear deal,

climbing oil prices and Trump’s agreement to grant sanctions waivers to eight

countries especially dependent on Iranian crude.

"Crude prices are rising. Even if Iran’s oil sales drop to 800,000 barrels per

day (bpd), we will be able to run the economy. But we will send much more than

that. Our economy will be far from collapse,” said a senior Iranian official.

"Our budget is based on oil of $57 per barrel and is now over $75 per barrel.”

Trump granted 180-day sanctions waivers to China, India, South Korea, Japan,

Italy, Greece, Taiwan and Turkey, which together took in over 80 percent of Iran

oil exports last year, Refinitiv Eikon data shows.

"Even without the exemptions, we will sell our oil. We will bypass sanctions. We

have so many countries that are on our side. America cannot do a damn thing,”

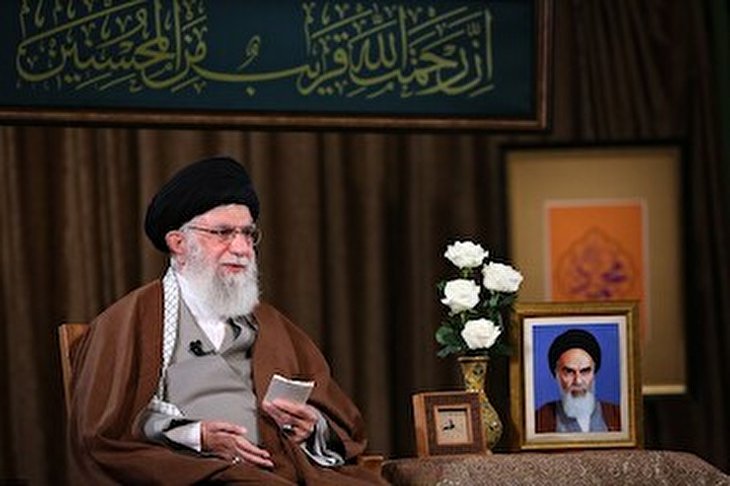

said a senior official close to Leader of the Islamic Revolution Ayatollah

Seyyed Ali Khamenei.

Iran demonstrated considerable resilience and ingenuity in coping with earlier

sanctions, and there is little to suggest Tehran could not do this again,

Reuters concluded.

Source:kayhan