Iran, India cushion oil money against US sanctions

People familiar with the matter told Bloomberg on Wednesday that India will

deposit payments for crude oil imported from Iran into escrow accounts of five

of their banks held with state-run UCO Bank Ltd.

"Payment into multiple escrow accounts will reduce the risks of Iranian bank

accounts being frozen in case the US brings new banks under sanctions,” they

said.

India bought $9 billion of crude oil from Iran in the financial year that ended

March 31, during which the south Asian nation took in 450,000 barrels a day.

Iran’s exports to India averaged 540,000 barrels per day this year, but they

should not exceed 300,000 barrels under the exemptions given by the US last

month.

The oil money held in escrow accounts will partially be used by Iran for imports

of essential goods from India and paying the rentals, salaries and other

administrative expenses of its diplomatic missions in the country, the report

said.

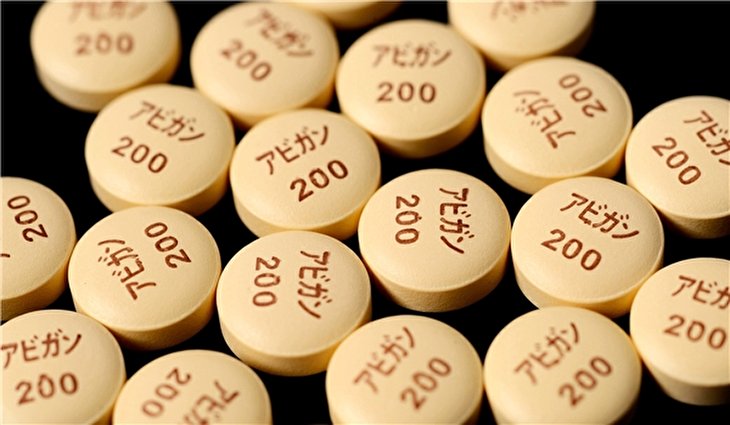

Iran usually imports medicines, rice, tea, yarn and rice as well as industrial

products from India.

According to India’s Directorate General of Commercial Intelligence and

Statistics, an arm of Ministry of Commerce and Industry, exports to Iran stood

at $2.65 billion last year.

Bloomberg cited UCO Bank Managing Director Atul Kumar Goel as saying that there

are 15 Iranian bank accounts in India, out of these five have come under US

sanctions but the remaining 10 are eligible to process bilateral transactions.

Iranian Minister of Health and Medical Education Hassan Qazizadeh Hashemi

suggested last week that Tehran may replace European and American

pharmaceuticals with Indian companies for imports of medicines.

"A major part of the European and US markets is dominated by the Indian

pharmaceutical companies, and the Islamic Republic has also used their products

in its industries,” Hashemi said at the end of a three-day visit to India.

"Unfortunately, our approach towards European and US companies is a traditional

one that should change. This change of view will surely benefit the country in

the future,” he said.

India, which imports nearly 80 percent of its crude requirements, sees Iran

imports crucial because many of its major refineries are adjusted to Iranian

grade.

Tehran also offers better credit terms than other oil suppliers and accepts

payments in rupees, which other Middle Eastern oil producers demand in US

dollars.

India is the second largest importer of Iranian oil after China. The two

countries have an arrangement under which 55 percent of oil payments are made in

euros and 45 percent in rupees through the UCO Bank.

New Delhi has also stressed its commitment to the development of Iran’s

strategic Chabahar port which India sees crucial to its connectivity ambitions.

Source:PressTV