INSTEX A Trojan Horse Tool to Infiltrate into Iran’s Banking, Defense Sectors: Researcher

"The launch of INSTEX — or the "Instrument in Support of Trade Exchanges” — by

France, Germany and the UK to facilitate non-dollar trade with Iran, is

seemingly a European circumvention of unilateral US sanctions on Iran, yet I

believe it is merely another Trojan Horse tool in a wider transatlantic ‘good

cop / bad cop’ production meant to inevitably infiltrate Iran’s banking, energy,

industrial, defense, security and technological firewall capabilities across

various industries,” Pye Ian told Tasnim.

Pye Ian is an independent economic and geopolitical researcher as well as a

strategic planning and business development advisor. His articles and analyses

on international affairs, economic trends and cultural topics have been

published in various mainstream and alternative press sources. Ian’s wider

intellectual interests are reflected in his writings on the convergence of

foreign affairs, political philosophy, history, global finance and energy

policy. He has undergraduate degrees in economics and political science from the

University of California and a Master’s degree in finance from Cambridge

University.

Following is the full text of the interview.

Q: After months of foot-dragging, Britain, France and Germany in early

Feb. issued a joint statement on the creation of a new trading system called the

Instrument in Support of Trade Exchanges (INSTEX) that will allow trade between

the EU and Iran without relying on direct financial transactions. What do you

think about this mechanism?

Ian: The launch of INSTEX — or the "Instrument in Support of Trade Exchanges” —

by France, Germany and the UK to facilitate non-dollar trade with Iran, is

seemingly a European circumvention of unilateral US sanctions on Iran, yet I

believe it is merely another Trojan Horse tool in a wider transatlantic ‘good

cop / bad cop’ production meant to inevitably infiltrate Iran’s banking, energy,

industrial, defense, security and technological firewall capabilities across

various industries. The US obviously serving as bad cop here, with its EU

partners serving as good cops, all meant ultimately to penetrate Iranian

financial and production capacities as much as possible under the auspices of

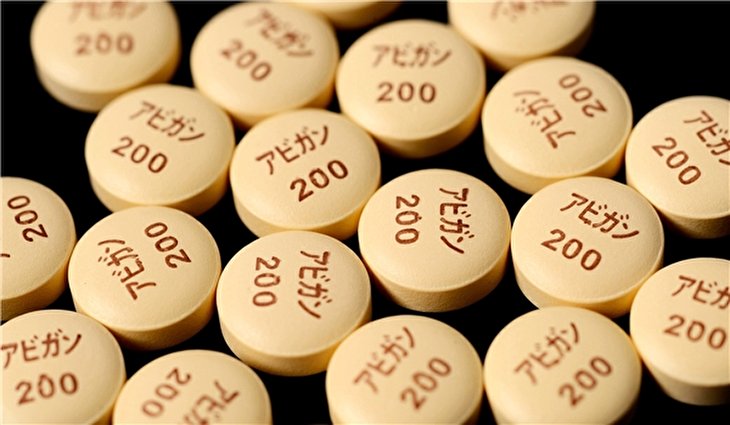

facilitating humanitarian goods-related transactions only, including food,

medicine, and medical equipment.

Let’s not forget that the damaging Stuxnet virus of a decade ago, which was

launched by US and Israeli cyber-terrorism efforts, reached its target via the

networks of trusted business partners. Early versions of the malware seemed

dedicated to intelligence gathering, but then later versions started attacking

internal infrastructure.

That mal-intentioned history is fairly recent, as is the more tellingly united

transatlantic approach to Iranian ally and fellow heavy oil-rich independent

nation, Venezuela, where you have the UK, France, Spain, Belgium and the wider

EU all on the same page as Washington with regard to demanding that President

Maduro step down in favor of a more western-compliant leadership. A return to

puppet-state status, basically. Ask why the US & EU would necessarily differ in

their collective approaches toward Iran & Venezuela, when both nations are

deemed as needing "regime change” ASAP by said Atlanticists? It’s simply because

of assigned tactical differences, yet the same underlying strategy toward both

persists.

Also, Iran is launching its 'crypto-Rial' cryptocurrency, reportedly meant for

facilitating future banking and institutional transactions, and will be followed

by a cryptocurrency that will be for more mainstream use. Related, Venezuela’s

already launched its Petro cryptocurrency, which is meant ultimately for pricing

& trading oil and other resources globally as well. The Petro in Caracas is seen

as a deep systemic fiscal threat by Washington, especially because the

Russian/Chinese allied approach toward Venezuela is helping with it. The clearly

unified transatlantic, Atlanticist west, which invented the internet &

blockchain technologies, will thus certainly not allow Russian & Chinese-allied

Iran nor Venezuela to simply circumvent its economic, fiscal & thus political

mandates – especially in oil pricing & trading - yet ostensibly needs different

tools for addressing each country, seeing that, despite heavy sanctions, trade &

currency wars against each nation, Iran’s internal situation is today more

sophisticated than Venezuela’s. Hence the deployment of seemingly friendly

European states in supposedly "going around” US sanctions.

Q: In one of your recent interviews, you equated the generally

"belligerent western approaches toward both Venezuela and Iran, essentially due

to the same reasons i.e. oil, gold, independence, leaning East and South

globally and de-dollarization”. Please explain more.

Ian: It’s no secret that, as mentioned, Iran & Venezuela both retain vast

amounts of untapped oil and other valuable natural resources. Yet both are also

working independently to circumvent dollar reliance for their energy resource

pricing, trading and receipt recycling. This significant political step is due

in part to punishing dollar-based economic sanctions, currency attacks,

embargoes and trade wars imposed against both Tehran and Caracas by the west,

and partly because their global eastern and southern hemispheric allies –

foremost Russia and China – are seeking to hoist and sustain a multipolar

international economic and geopolitical order free of imperial, "Full Spectrum

Dominance” mandates from the increasingly belligerent actors pushing "The

Washington Consensus”.

The US dollar has served as global reserve currency since the end of World War

II. It has also been a fiat currency – meaning a currency that a government has

declared to be legal tender, but which is not backed by a physical commodity –

since August 15th, 1971, when the Nixon Administration in the US ended the

convertibility of dollars into physical gold, which was a key economic

stipulation resulting from the Bretton Woods Conference held just before the end

of World War II.

Two years after "the gold window” ended, Washington struck a key deal with Saudi

Arabia to have oil exclusively priced in US dollars, with the rest of OPEC

following suit with said plan in 1975. "Petrodollar Recycling” resulted, where

dollar earnings for oil production & commerce would be ‘recycled’ into US

Treasury Bonds. The total deal ended up replacing direct gold tethering with

indirect oil reliance, essentially, with regard to the means for continuing to

prop the US dollar up as reserve currency. "Confidence” in the dollar continues

unabated because oil bought anywhere must be priced, traded & reinvested using

dollars. It also allowed Washington to, in essence, print dollars infinitely for

any purpose without endangering its deficits like any other nation would.

Said deal also enabled the dollar to eventually be used as a weapon against any

other currency on earth, considering that the rest of the world’s currencies

are, by default, fiat as well, following the dollar’s imposed lead. That ‘dollar

weaponization’ thus results in the rather easy ability of Washington to

negatively target dollar exchange rates. We’ve seen the purposefully deleterious

results of such a tool fall upon the Iranian rial, the Venezuelan bolívar, the

Russian ruble, the Zimbabwean dollar, and certainly even the Turkish lira, all

as political acts from Washington and London. As the national currency weakens,

the intention goes, so would eventually the targeted government’s hold on power,

thereby resulting in – at the least – mass, continuing, destabilizing riots in

the streets. If the targeted government doesn’t ‘change its ways’, then the

pressure is ratcheted up via sustaining those mass riots while a military coup

or its ilk would be planned within said nation.

The responses from nations such as Iran, Venezuela, Russia, China and even

NATO-membered Turkey (which defeated its Washington-backed coup attempt in 2016,

with tacit Russian assistance) have been to individually and more importantly,

collectively, seek "de-dollarization”, which includes generally seeking to

reduce dollar-based transactions, dumping US Treasury Bonds out of their

national reserves, relying upon bilateral currency usages with other nations

(I.E. ruble/yuan, lira/ruble, rial/yuan, etc.), and most critically, aiming at

reimplementing key commodity backing for their currencies. In the cases of both

the Iranian and Venezuelan national currencies, the reintroduction of the use of

physical gold for affording solvency & credibility to their currencies has been

carried out over the past few years.

In turn, tying such rejuvenated currencies to how they wish to price, trade and

recycle the earnings for oil, natural gas and minerals trades out of their

respective territories has also been spearheaded as a geostrategic response to

years of economic harassment & outright acts of war from the west.

Lastly, innovation research into exploring how safe, protected and deployable

(scalability-wise) the use of cryptocurrencies would be vis-à-vis both the gold

and oil tie-ins for national currencies has been proceeding in said independent

nations as well.

Importantly, the assistance of Russia and China for conceptualizing,

implementing and inevitably scaling such de-dollarization has been vital because

Moscow & Beijing are more tightly allied now than ever before. Through the

combination of their natural resources (oil, natural gas, gold, steel, coal,

copper, etc.), economic prowess (China’s is the strongest human resource

production engine in world history), political visions and international

institutional mobilizations (the Eurasian Economic Union, New Silk Road,

Shanghai Cooperation Organization, Asian Infrastructure Bank & New Development

Bank, BRICS, etc.), and last but not least, combined military capabilities

(millions of combined personnel, both nuclear-armed, and having conducted

countless joint military drills for many years now), Russia and China lend

continual guidance, reassurance & protection to their Eurasian, West Asian, East

Asian, African, Latin American and, yes, even European allies & trading

partners.

The Atlanticist west, led by the US but including the UK, UK Commonwealth, EU,

Israel, Saudi Arabia & other Persian Gulf states, is collectively determined to

prevent such independent Eurasian movement away from dollar hegemony, foremost

because such a move – successfully actualized and expanded – would devastate the

already over-leveraged state of transatlantic banking and finance, which sits on

combined amounts of debt numbering in the tens of trillions of dollars. Once

synthetic derivatives contracts and other ‘dark finance pool’ instruments are

included, then the risk profile issued from western financial institutions

measures a cascading fiscal cataclysm as involving hundreds of trillions of

dollars.

Why are said massive debt figures significant? Because the sanctity of a)

continuing to issue debts endlessly, and b) preventing said debt bubbles from

unraveling violently, unpredictably and in politically threatening ways, all

rely upon maintaining the US dollar as both the perennial reserve currency and

petro-currency standard until the ruling transatlantic Establishment decides to

replace said protocols themselves (be it with Special Drawing Rights issued by

the IMF as dollar-replacements, or with state-approved cryptocurrencies, or the

like). Torpedoing dollar and petrodollar hegemony are what the global East and

South seek, and hence the world economy right now resembles a ‘Tug of War’, with

currency credibility serving as the ‘rope’ in said battle.

Q: As you know, EU officials have repeatedly expressed the bloc’s

determination to preserve the JCPOA. Recently, US Vice President Mike Pence

said, "(This is) an ill-advised step that will only strengthen Iran, weaken the

EU and create still more distance between Europe and the US”. Do you believe

that the EU will finally stand up to the US or it is just a bluff game?

Ian: As I’ve stated, and based upon a sober reading of both history, viable

economics and even of esoteric philosophy (as read by the ruling Establishment),

it is a bluff game, foremost because the governments, banks & general economic

systems of the US, UK, EU and their subject nations are run by the same ultimate

Syndicate of power, which is very old, very occult in its epistemological

provenance, make-up and aims, and very coordinated in meeting its universal

challenges, despite seemingly contradictory stances taken by, say, the US and EU

with regard to Iran.

So, EU nations seemingly differ with Washington on Iran, yet I’d be very

cautious if I were in Tehran. Where we’ve ended up here on the JCPOA clearly is

NOT about preventing the proliferation of nuclear weapons, but about – as

mentioned above - sovereign independent national economic imperatives vs. those

of an Atlanticist empire which won’t tolerate disobedience.

You’ll notice how the EU is on the same page as Washington & London regarding

wanting Maduro out of power in Venezuela in favor of their corporate compliant

puppet, Juan Guaidó. And yet we’re led to believe that the US & EU, by contrast,

genuinely differ regarding medium to long term preferences on Iran? When, as

mentioned, both Iran & Venezuela are oil & resource-rich independent nations

working with the global East in divorcing from dollar hegemony?

German Foreign Minister Heiko Maas over-spoke in his recent speech by admitting

that "our goal remains an Iran without nuclear weapons, precisely because we see

clearly how Iran is destabilizing the region".

Wow. Really, Europe? If that is how you truly feel, then Maas just revealed some

of the transatlantic community’s playing cards, as this is clearly a ‘good

cop/bad cop’ theatrical routine, with the EU playing good cop & the US & its

tightest allies playing bad cops.

Iran does NOT intend upon pursuing nuclear weapons & Tehran has made that

abundantly clear for years now by holding steadfastly to the JCPOA nuclear

agreement. Instead, this is really about preventing Iran from pursuing an

independent economic & global energy policy, just as it is against Venezuela

doing the same. Sustained global non-dollar oil trading by Iran, Venezuela,

Russia, China & Turkey would trigger incalculable instability across global bond

and equity markets, causing immediate failure for already endangered banks which

carry trillions in debts on (and purposefully off of) their official balance

sheets. Hence the ramped up belligerent talk by Washington against both Iran &

Venezuela.

US Vice President Pence also criticized the initiative of France, Germany and

Britain to allow European companies to continue operating in Iran despite US

sanctions. That is also a tool of deception, via a smokescreen criticism, as the

US, UK & EU want corporate, technological & intelligence transparency across the

totality of Iranian banks, companies, and everything else, one way or another.

Q: Will the JCPOA stand?

Ian: It is hard to tell, yet the proverbial ball is in the court of the US and

its faithfully compliant allies. This is because – again – Iran has been both

adherent to the JCPOA’s mandates and stipulations, and forthright in goodwill

fashion about its wish to continue to abide by the JCPOA.

Yet the JCPOA obviously did not achieve what it partly set out to do – namely,

either force a presumably frustrated Iran to pull out of the agreement – thereby

giving a casus belli for the west to take harsher measures against Tehran – or

yield other desired political capital, such as blowback at home, where Iranians

revolt against a seemingly weak government. Hence why the Trump Administration –

run ultimately by behind-the-scenes neoconservative and neoliberal planners

beholden conclusively to the sweeping, coordinated Syndicate or Establishment I

referenced above, rather than by either Trump, his Cabinet or even his

‘advisors’ – voiced irrational frustration over the JCPOA from even before

Trump’s admission into the White House. They’ve been out-witted and outclassed

by Tehran, and so now need to mix strategies up a bit via their appointed

"Madman Theory”-laden disruptive politician in chief.

Source:Tasnim