ROPEC Appearance and Its Impact on Global Oil Industry

TEHRAN (Basirat)- Now, with Russia stepping in to negotiate with OPEC nations, a new picture is emerging. This question comes to mind whether or not Russia will affect the global oil market. Will oil reach $100 a barrel?

Now, with Russia stepping in to negotiate with OPEC nations, a new picture is emerging. This question comes to mind whether or not Russia will affect the global oil market. Will oil reach $100 a barrel?

BY Kaveh Fadaei

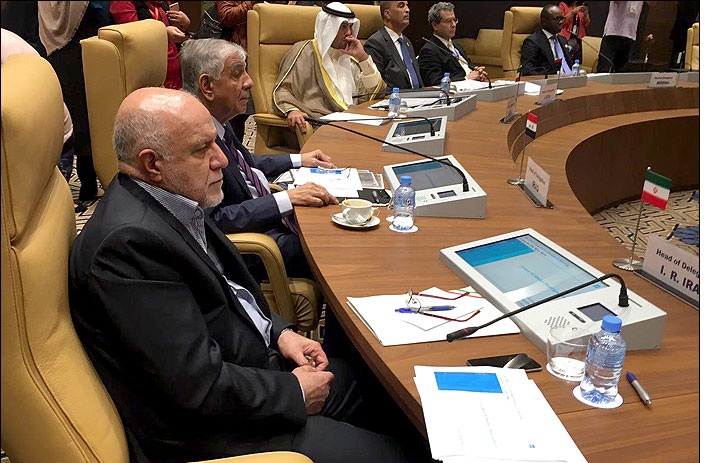

Following the meeting of the world's major oil producers in Algeria in late September, the Organization of Petroleum Exporting Countries (OPEC) started a new round of its activities as the oil cartel managed to accompany Russia with itself for implementing important policies, such as freezing or reducing oil production.

OPEC member states plan to found a new organization called "ROPEC” (Russia and OPEC nations) in order to execute the oil freeze plan. Russia will play the pioneering role in implementing the plan.

That is why OPEC Secretary General Mohammed Barkindo said during the meeting that the organization had firm commitments from Russian president Vladimir Putin that the world’s largest energy exporter is willing to participate in a coordinated effort to curb oil production.

Accordingly, Iranian Oil Minister BijanNamdarZangeneh described the Algeria meeting as a "historic” event.

Russia’s joining OPEC and its cooperation for implementation of the oil cartel’s policies can have a major impact on the global oil industry as it is the world's second-largest crude oil producer and can motivate Kazakhstan, Azerbaijan and other former Soviet countries to joint ROPEC.

Also, Russia’s political talks with Iraq, Kuwait, Qatar, United Arab Emirate (UAE) and Saudi Arabia could cause these countries’ compliance for implementing the oil freeze plan.

However, one should not forget that Russians were also concerned about stumbling oil prices and OPEC collapse, and feared that their oil and gas markets would be affected accordingly. Therefore, they see any weakness in OPEC and its policies as detrimental to their own oil industry and are trying to play a constructive role in stabilizing the global oil market.

Oil and energy ministers of OPEC member states reached a deal in the Algeria informal meeting to cut their production to 32.5 million barrels per day. The OPEC is yet to decide how much each country will produce in its next meeting in November. However, three countries are exempted from the production cuts: Iran, Nigeria and Libya.

The OPEC reached a consensus to help stabilize the global oil market and reduce the volatility of oil prices. According to the deal, Iran can demand production quota and return to its previous status before sanctions era. The Islamic Republic can also increase its oil and Hydrocarbon exports.

Iran will reach the pre-sanctions level by producing 4 million barrels per day (bpd) of crude. Therefore, it is better for the Islamic Republic to improve its oil talks with OPEC member states and make it clear that it can increase its production and reclaim its previous share in the global oil market, including India, China, South Korea and Japan. Due to the sanctions, Iran’s output decreased to a large degree and now time is ripe for increasing oil exports.

14 members of OPEC currently produce 33.24 million bpd crude and, on Sept. 28, they agreed to reduce their output to a range of 32.5 million barrels per day to 33.0 million bpd, its first output cut since the 2008 financial crisis.

Now, with Russia stepping in to negotiate with OPEC nations, a new picture is emerging. This question comes to mind whether or not Russia will affect the global oil market. Will oil reach $100 a barrel? Will OPEC be dissolved with ROPEC’s appearance? Will the nascent ROPEC be able to control the global oil prices? Will ROPEC’s statements be effective? Is Russia seeking to improve OPEC member states’ economic conditions or is it just pursuing its own interests and influence? Will ROPEC near oil-rich countries to peak of oil prices? Will ROPEC be able to contain the West’s infiltration in the implementation of the global oil policies? Will the US and western countries move toward interaction or confrontation with ROPEC’s appearance? Can ROPEC reduce Saudi oil production to under 10 million bpd?

The 170th regular meeting of the OPEC will be held on November 30 in the Austrian city of Vienna to study the latest developments in the global oil market. It would be a good opportunity for the oil cartel’s member states to answer the above-mentioned questions and shed light on the entity of ROPEC.